The SEC officially sanctions trading in another crypto-based ETF.

Kamala Harris courts the crypto crowd.

South Korea introduces new exchange regulations.

Seven states take on SEC.

Ooh, trouble-free transmission, helps your oils flow

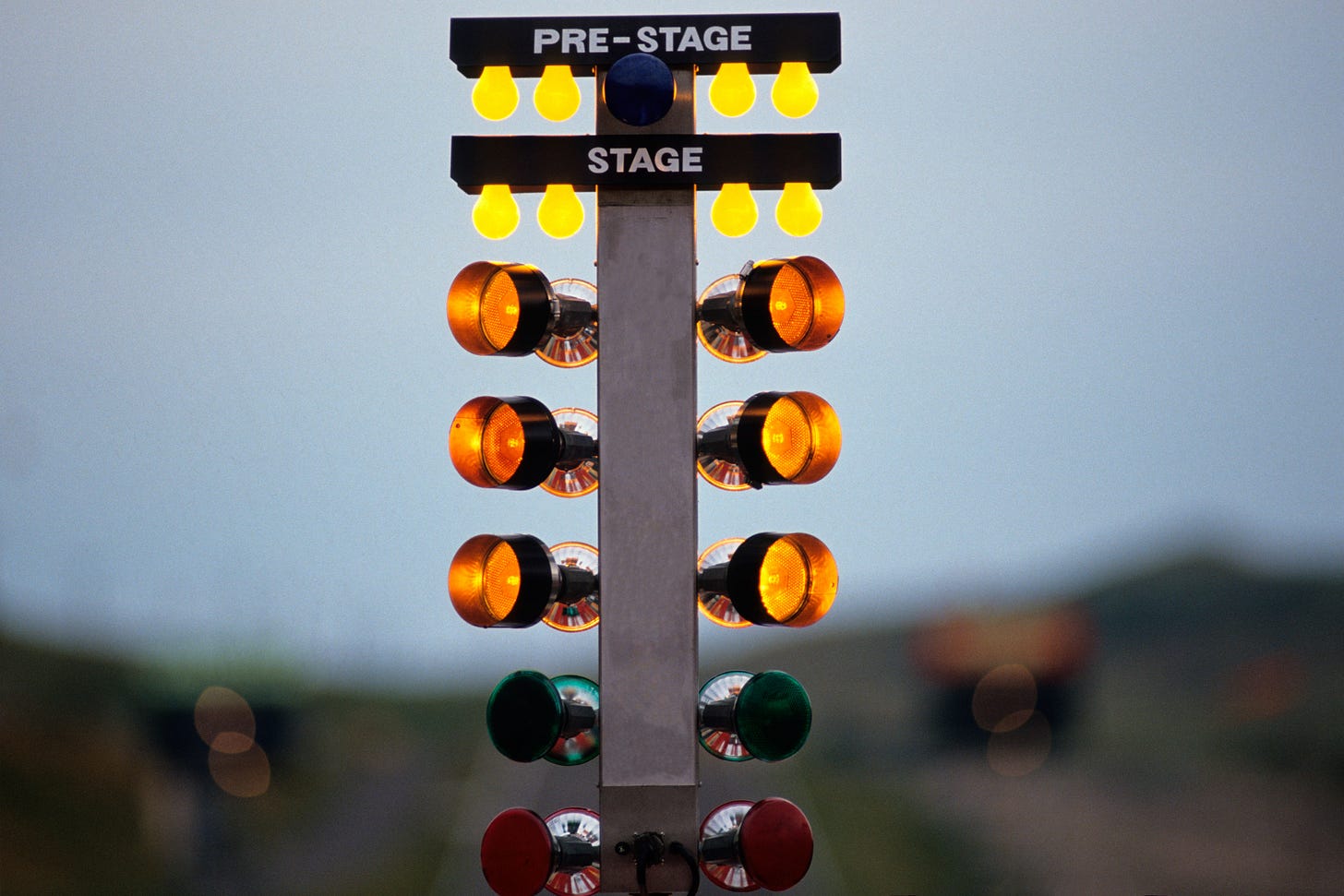

Ether ETFs are go

Take off: Money rushed into the first Ether ETFs this week after the US Securities and Exchange Commission (SEC) approved nine Ether ETFs offerings after more than 12 months of deliberations. It marks the second entry of a major cryptocurrency in the funds sector following Bitcoin’s approval in January.

The nine Ether ETFs can be traded through traditional brokerage accounts.

Available are products from crypto asset managers Grayscale, along with leading wealth managers BlackRock and Fidelity.

Second prize: Ethereum is the world’s second-largest crypto token behind Bitcoin, and has a market cap of nearly half a trillion dollars. Last year, Ether futures ETFs were approved for institutional investors.

Embrace the space: “Traditional asset management can no longer ignore crypto as an asset class,” said Matt Hougan, chief investment officer of crypto fund sponsor Bitwise. “I think you’re going to see effectively everyone embrace this space.”

Cboe Global Markets lists five of the Ether ETFs. It said trading early on Tuesday showed plenty of positives.

“All products opened for trading smoothly, with strong participation from our dedicated market makers who have been actively quoting and providing liquidity from the outset,” Cboe said in a statement.

“Being the first to file for an Ethereum ETF back in 2021, we have long believed investors should have access to Ethereum exposure in a vehicle they find accessible and familiar,” added Kyle DaCruz, director of digital assets products at VanEck.

“If Bitcoin is digital gold, then Ethereum is the open-source App Store and the gateway for exposure to the thousands of applications that will utilize blockchain technology.”

Do I move you: Attention is turning to the price of Ether as the approval of the Bitcoin ETFs helped send the price of the coin up 50% since the start of the year. Some analysts have said they expect spot Ether ETFs to move the price upward, but note that inflows into those funds are likely to be shallower than their Bitcoin counterparts due to not having first mover advantage.

Research firm Steno Research has predicted that ETFs could see $15bn-$20bn worth of inflows in the first year; the Bitcoin ETFs hit this figure within seven months.

Some analysts predict that while a spot ETH ETF could move the price of ether up to $6,500, inflows into those funds won't be nearly as high as for their bitcoin-focused counterparts.

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

No surprises: Cryptocurrencies are growing in popularity among money launderers, a new report by Chainalysis has found. Researchers studied trends and newer ways of laundering money, and found crypto is being used for off-chain crimes such as drug trafficking and fraud due to being “cross-border, virtually instant and generally inexpensive to transact”.

Since 2019, almost $100bn in funds have been sent from known illicit wallets to conversion services – where crypto is converted to fiat currency, data showed.

Take a look around: US House of Representatives legislators have voted to establish a working group to research the illicit use of digital assets. Members approved the Financial Technology Protection Act on July 22.

The bill, introduced in April 2023, aims to address how “rogue and foreign nations” could use decentralized finance to dodge sanctions, and how money-laundering controls could be tightened.

I’m so blind: The Internal Revenue Service (IRS) isn’t doing enough to stop tax avoidance by users of virtual currency or digital assets, according to the US Treasury. A report by the Treasury Inspector General for Tax Administration reviewed the IRS’ Operation Hidden Treasure, which sought to identify taxpayers who omit digital assets, such as cryptocurrency, from their tax returns.

However, anonymity of virtual currency and lack of reporting by exchanges has hindered the IRS’ attempts at enforcement, the inspectorate noted.

Kamala’s crypto courtship

Turn the beat around: Crypto lobbyists are putting pressure on prospective Democratic presidential nominee Kamala Harris to make room in her campaign for digital assets.

Harris, who has most-likely replaced President Joe Biden on the ticket for November’s election, has said very little about digital currencies in her years as a senator or as Vice President.

With Republican nominee Donald Trump making a naked play for the sector’s support, and telling media he will be the first “crypto president”, the Digital Chamber has warned the Democrats they have some catching up to do.

“There is a public perception that the party holds a negative viewpoint on digital assets, largely due to the Biden/Harris administration’s notably cautious and at times hostile approach to these transformative technologies,” the powerful Washington, DC-based association said in an open letter.

“We are hopeful that with your leadership, the Democratic Party can pivot towards a more supportive stance on digital assets, aligning with the aspirations of millions of Americans who believe in the transformative power of this technology,” the group said.

Destiny calling: Billionaire investor and Bitcoin bull Mark Cuban said Harris’ team have already reached out to him, indicating signs of a thaw.

Cuban told Decrypt he was getting “multiple questions from her camp about crypto”.

“So I take that as a good sign,” Cuban said. “The feedback I’m getting, but certainly not confirmed by the VP, is that she will be far more open to business, [artificial intelligence], crypto and government as a service”.

Feed the machine: Trump, meanwhile, is getting ready to speak at the Bitcoin Conference in Nashville this week.

The former president continues to win the support of crypto advocates, and has tapped into a rich vein of funding within the sector.

Fairshake, a pro-crypto super PAC, has raised $203m in a handful of months, making it the largest independent political spender of the current election cycle.

The PAC independently funds political candidates and other regulatory initiatives to provide clearer legal frameworks for blockchain technology in the US.

South Korea

Talkin’ tough: South Korea’s new crypto investor protection regulations are now live. The Virtual Asset User Protection Act, overseen by the country’s Financial Services Commission (FSC), introduces measures designed to protect users buying and storing crypto assets with virtual asset service providers.

The regulator will also have powers to go over suspect operations as it hopes to avoid a repeat of the scandals such as the collapse of the FTX exchange, which lost investors billions of dollars.

“The FSC expects that the implementation of the Virtual Asset User Protection Act will establish a foundation to provide safe protection for users,” the FSC said. “As it becomes possible to bring severe penalties against those engaging in unfair trading activities, it is also expected to help establish a sound order in the virtual asset market.”

It’s all there: Under the law, digital assets are defined as electronic tokens with economic value that can be traded or transferred electronically. Alongside traditional forms of crypto such as Bitcoin, the regulations also cover non-fungible tokens (NFTs).

To shield investors from any market crash, crypto exchange operators must deposit users’ funds in financial institutions, such as banks, as a measure of protection.

Exchanges must also pay interest on these deposits, with rates between 1% and 1.5%.

As an additional security measure, exchanges must keep some investor virtual assets in cold wallets, and they are required under the law to keep reserves aside and get insurance.

Watch your step: The regulator will conduct frequent checks to guard against unfair trading, and exchanges themselves are obliged to report suspicious transactions, which covers events such as unusual price swings and trading volumes.

“The financial authorities plan to continue to seek stronger cooperation with investigative authorities and actively seek improvements to make sure that the new law is effectively implemented,” the FSC said.

It added, however, that even the new regulations could not guarantee user funds would be protected given the risks that surround crypto.

Your crime is time: Separate legislation allows the FSC to jail persons who violate the country’s crypto laws.

Last year, the FSC introduced laws which carry a jail term of at least one year or fines of up to three or four times that of the illegal gains.

Criminals who rake in more than $4m from illegal crypto schemes could face life terms.

States’ rights

Strength in numbers: Seven US states have collectively filed a court brief opposing the Securities and Exchange Commission’s (SEC) attempt to regulate cryptocurrencies. Led by Iowa Attorney General Brenna Bird, the group includes Arkansas, Indiana, Kansas, Montana, Nebraska and Oklahoma.

The states argue that the SEC’s regulatory actions are a significant overstepping of its boundaries and could harm innovation within the crypto sector.

They believe the SEC’s alleged regulatory creep obstructs the states’ own efforts to protect citizens from fraud.

Illegal and unchecked: The Iowa Attorney General’s office said the SEC is attempting to grant itself new powers, without approval from Congress, which amounts to an illegal, unchecked action. According to the brief, the SEC is alleged to have violated the Administrative Procedure Act and the Major Questions Doctrine.

The states also claim that typical cryptocurrencies do not fall under the investment contract category as defined by the Securities Exchange Act of 1934, which is central to many of the SEC’s cases against big name industry exchanges.

Events calendar

Aug 1: Coinbase Q2 call

Aug 7: Robinhood Q2 call

Aug 13-14: Blockchain Futurist Conference, Toronto

Sep 11-13: Permissionless II, Austin

Sep 25-26: European Blockchain Convention, Barcelona

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.