NFTs are art not financial instruments, says OpenSea CEO.

In Loose change: FTX payback warning.

Gen Z bookie Rivalry talks up the early signs of token success.

First UK crypto ATM charge.

Modern art makes me want to rock out.

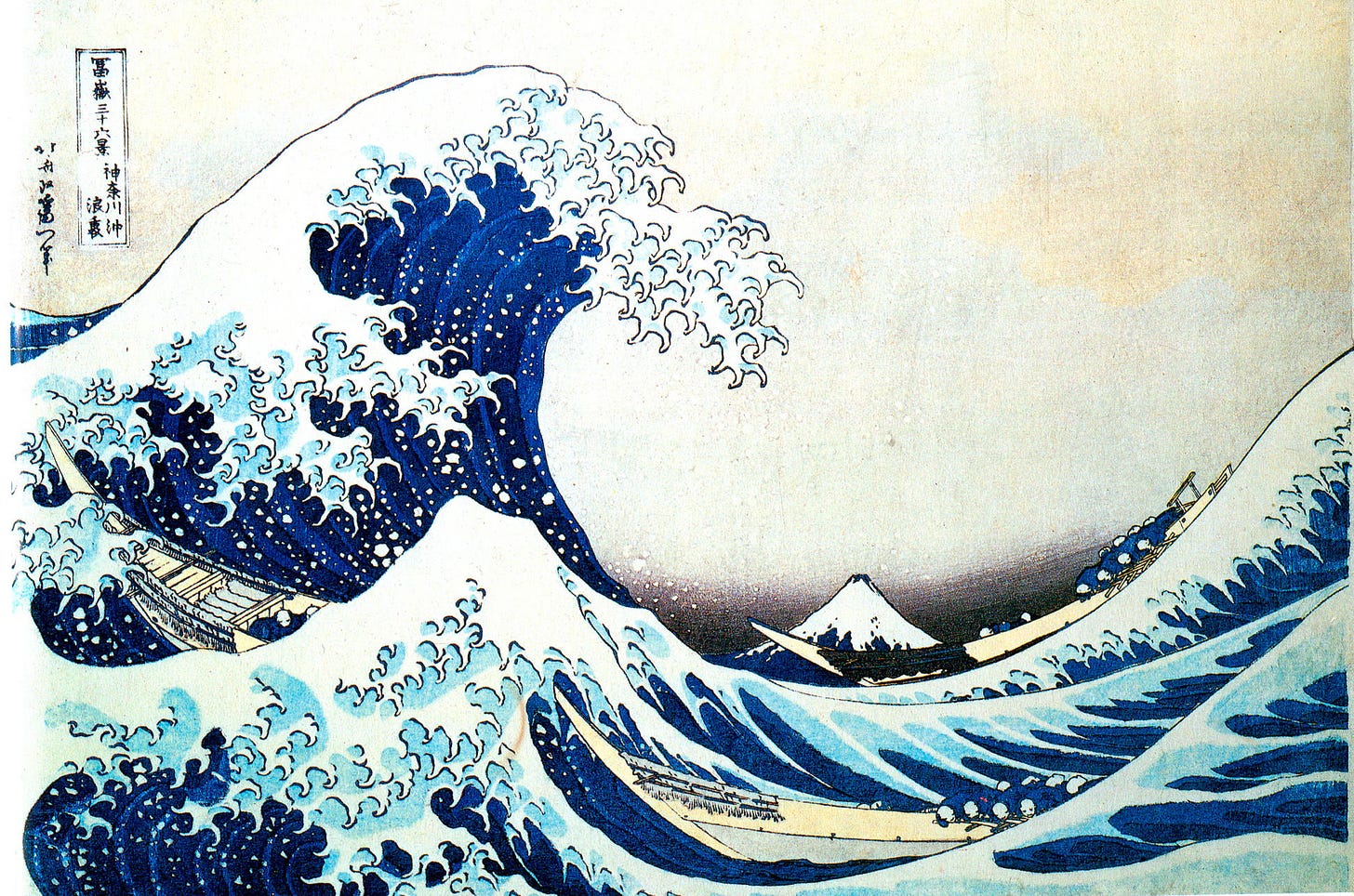

Sea change

Art for art’s sake: NFTs are “fundamentally creative goods” and shouldn't be treated in the same fashion as financial instruments such as collateralized debt obligations, said Devin Finzer, the CEO at OpenSea, after the SEC’s latest intervention in the token world.

Finzer revealed via an X posting last week that his company was subject to a Wells notice from the US financial regulator.

A Wells notice is one of the final steps before the SEC issues formal charges and lays out the arguments it will make to justify its actions.

Finzer said he was “shocked” the SEC, by concluding that NFTs are securities, had made “such a sweeping move against creators and artists,” adding that OpenSea was “ready to stand up and fight.”

In doing so he said OpenSea would join the likes of Coinbase, Uniswap, Robinhood, Kraken and Consensys in the regulator’s “crosshairs.”

Recall, in late July, DraftKings cited the potential for its NFTs to be classified as securities for its decision to call a halt to its digital collectibles businesses Reignmakers and Marketplace.

Off the map: Finzer said that by attacking the digital creative community, the SEC was now in “uncharted territory.” By targeting NFTs, the regulator would “stifle innovation on an even broader scale” and put hundreds of thousands of creators “at risk” and without the resources to defend themselves.

These included student artists “finding full-time careers in selling their digital art.”

Indie game developers, who had used NFTs to “instantly enable open markets for their in-game items, without having to build marketplaces from scratch.”

Then there were “passionate collectors” joining new communities, all centered around shared digital ownership.

Finzer said it would be a “terrible outcome if creators stopped making digital art because of regulatory saber-rattling.”

War chest: To facilitate the fight and to help digital creators fend off the attentions of the financial regulators, Finzer said OpenSea was pledging $5m to help cover legal fees for any creative who also received a Wells notice.

Rallying cry: “Every creator, big or small, should be able to innovate without fear,” said Finzer.

“I hope the SEC will come to its senses sooner rather than later, and that they’ll listen with an open mind. Until then, we’ll stand up and fight for our industry.”

Purring along: Meanwhile, hints of a return to favor for NFTs has been glimpsed with the latest release from one of the oldest Ethereum-based collections, CryptoKitties, which quietly launched an open edition mint for its ‘Eggs’ collection on August 30.

Originally priced at 0.008 ETH ($20) per NFT, the Egg NFTs are now trading at 0.3 ETH ($720) apiece, more than 35 times the mint price.

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

Your cash ain't nothin but trash: Collapsed crypto exchange FTX wants to pay creditors back with stablecoins, much to the anger of regulators. The SEC warned it may legally challenge payments that are not made in greenbacks.

In a filing to the United States Bankruptcy Court in Delaware, lawyers from the SEC admitted the plan to repay using stablecoins isn’t technically illegal, but it would fight any attempt to do so.

FTX has attempted several liquidation plans, including a doomed effort to restart the exchange in an attempt to make creditors whole.

Far from marginal: A new research paper into the political, psychological and social correlates of cryptocurrency ownership suggested crypto purchasers, on average, share an “eclectic mix of political attitudes, identities and predispositions.”

This contrasts with past claims that crypto currencies are some sort of financial shibboleth of the far right, the authors concluded.

“Future work would benefit from more deeply investigating possible connections between the motivations underlying cryptocurrency ownership and specific partisan world views and ideologies,” the report added.

Meet the in-laws: Having outlawed crypto in 2018, Qatar has introduced a licensing scheme for businesses to provide digital asset and token services.

The QFC Digital Assets Framework 2024 “establishes the legal and regulatory foundation” for digital assets, including the process of tokenization, legal recognition of property rights in tokens and their underlying assets, custody arrangements, transfer and exchange.

Been caught stealing: Crypto casino and decentralized finance project Mpeppe has been accused of stealing investors funds via a fake presale, according to Cointelegraph.

Poles apart: The former CEO of the collapsed Japanese Bitcoin exchange Mt. Gox is back with a new crypto platform. Mark Karpeles has announced EllipX will be headquartered in Poland, and in compliance with the European Union’s new Markets in Crypto-Assets (MiCA) regulatory framework.

More FTX fallout: The collapse of FTX continues to claim scalps as US officials have charged a former investment advisory that lost half of its funds when the bankrupt exchange collapsed.

Galois Capital Management is being sued by the US Securities and Exchange Commission over alleged violations of the Investment Advisers Act, and for misleading investors about its redemption policies.

What we’re reading

Reserve warning: “Bitcoin promotion by the White House would chip away at the status of the dollar at a time when sentiment towards the currency is likely to be tested.” In the FT.

Can tokens save Rivalry?

Token effort: Rivalry’s token is one of two key areas the company hopes will go some way to reversing its disastrous share price performance, which has seen the stock drop by over 70% in the YTD, including a 17% fall on the day after its earnings release.

CEO Steven Salz said on the call with analysts that the share price performance was “not where our investors or our team wanted to be.”

Going native: Salz restated Rivalry’s ambition to be the “defacto online betting product brand and experience for digitally native consumers” and the company clearly now sees its crypto as playing a significant role in that effort.

Subsequent to Q2, Rivalry said the RVLRY token drove C$1.7m ($1.3m) of pre-purchasing revenue with the company claiming it had gained “meaningful traction.”

Salz added that the additional revenue being generated by the token was “quite additive.”

The RVLRY token is the operator’s own cryptocurrency announced in May but which is “yet to fully launch.” However, customers are already engaging with the product, connecting it with their crypto wallets and earning rewards.

We love our audience: Salz said the first stage of the RVLRY launch had been a “most successful” reactivation campaign, attracting an audience that was twice as valuable as the average user.

The upward trends in revenue and player engagement were, he insisted, “by design and closely connected to the utility and value” created by the token.

To continue the progress, Salz said the company hoped to release new social-based products and games to drive connected wallets, acquire users and capture market share in the crypto gambling segment.

The token generation event – TGE – is set to take place later this year, at which point users will receive their tokens directly into their crypto wallets. The token will also be listed on the exchanges.

🛝 Hitting the skids: Rivalry’s share price performance this year

You’re nicked

Check my machine: A London trader suspected of operating an illegal cryptocurrency ATM is believed to be the first person in the UK to be charged with such an offense.

Last year, officers raided a Gadcet shop in Kent, UK, and seized a number of crypto ATMs including one that was on public display.

Habibur Rahman, 37, of Langdon Crescent in East Ham, London, was arrested the same day and has now been charged with operating the machine without registration from the Financial Conduct Authority (FCA)

He is also alleged to have laundered £300,000 of criminal cash by converting it into cryptocurrency, and was bailed to attend court in October.

“There are currently no crypto ATMs registered with the FCA – so if you’re using one of these machines you could be handing your money to criminals,” said Matthew Long, director of payments and digital assets for the FCA.

Events calendar

Sep 25-26: European Blockchain Convention, Barcelona

Oct 9-11: Permissionless III, Salt Lake City

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.