Robinhood buys global exchange to expand its crypto reach.

Loose change: crypto bros flock to Trump SF fundraiser.

Zach Bruch talks about his latest venture MyPrize.

EU security chiefs warn of mixers, privacy coins.

Make it really loud, make the biggest sound.

Stamp collecting

Stamp of approval: Robinhood has furthered its cryptocurrency ambitions with the $200m all-cash offer for the global crypto exchange Bitstamp, which it said would “significantly accelerate” its ambitions in the crypto space. The deal is expected to close in H125.

Bitstamp has over 50 active licenses and operates in the EU, the UK, the US and Asia.

The acquisition will be Robinhood’s first international business.

Branching out: Among Bitstamp’s core offerings is its spot exchange, which currently enables trading on a total of 88 assets while also providing staking and lending to its customer base.

Business is booming: Johann Kerbrat, GM of Robinhood Crypto, said Bitstamp had demonstrated resilience through various market cycles, adding that it would enhance Robinhood’s own crypto offering. In May’s Q1 earnings, the company said its crypto-based transaction earnings rose 232% to $126m.

Crypto assets under custody also increased 65% YoY to $129bn, helped by higher cryptocurrency valuations.

In the May trading data released yesterday, Robinhood said crypto trading volumes rose 238% YoY to $7.1bn, although this represented a MoM drop of 30%.

Fight the power: Recall, CEO Vlad Tenev said on the company’s Q1 earnings call that its ambitions for the crypto business would not be dimmed by potential regulatory actions on the part of the SEC. CFO Jason Warnick said at the time that Robinhood had been “very conservative in our approach in terms of coins listed and services offered.”

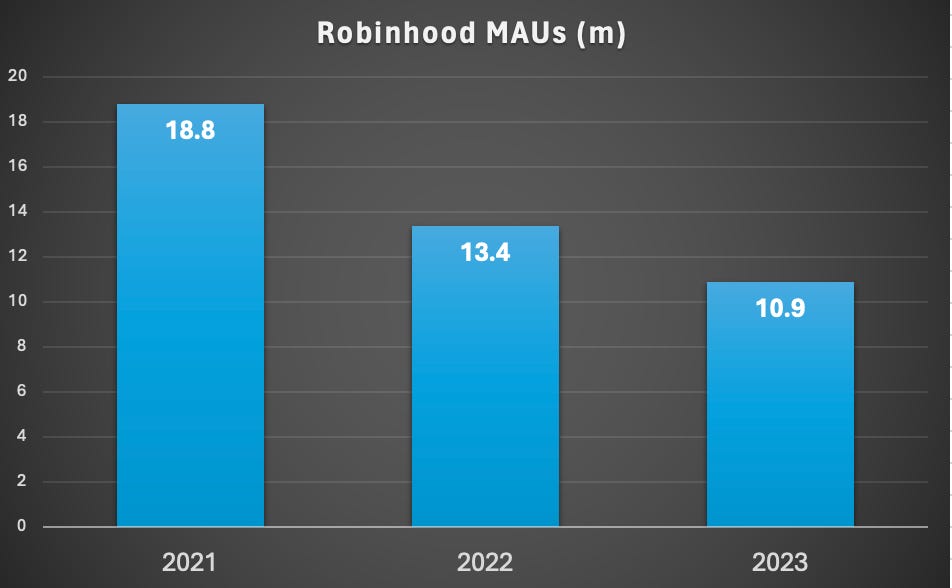

User loser: Analysts speculated that a further push into crypto exchange offerings might help Robinhood regain some ground in total user numbers, which have fallen back since the height of the meme stock craze of the pandemic.

Data from the company shows that user numbers peaked in 2021 at 18.8m before falling the next year to 13.4m and to 10.9m in 2023.

🚧 Needs juicing: Robinhood’s MAUs in decline

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

Another girl, another planet: Japanese investment firm Metaplanet has added ~$1.6m of Bitcoin to its balance sheet, according to a filing late last week. In a posting on X, the firm’s director of Bitcoin strategy said it now holds 141.07 Bitcoin or the equivalent of $9.2m.

Crypto ♥ Trump: Representatives from Coinbase were among various other Silicon Valley tech luminaries who contributed to a fundraiser hosted by David Sacks in San Francisco last week.

A posting on X from Republican party official Harmeet Dhillon said “many crypto leaders [were] in the house.”

Matter Labs, the team behind ZKsync, has released details of its long-awaited airdrop, saying that 17.5% of the token’s supply or 3.6 billion tokens has been earmarked for the project’s community. Nearly 700,000 wallets are eligible for the drop, but allocations are capped at 100,000 tokens each.

Litter tray: On the back of a series of tweets from Keith Gill, aka YouTube investing sensation Roaring Kitty, and a live streaming event that attracted more than 600,000 viewers at one point, meme stock favorite GameStop once again took advantage by issuing $2.14bn of new shares.

However, the live stream was not universally loved. On X Dave Portnoy said it was a “tactical error” and “didn’t really work out.”

“The company’s no good but the fundamentals don’t matter,” he said. “He should have continued to operate in the shadows.”

Rumor mill

Next up: With an Ether ETF not even out of the gate, attention has turned to what could be the next coin ETF. Spoiler alert: it’s Solana…

What we’re reading

Miller time: Investor Bill Miller says in a blog posting that despite Bitcoin’s recent highs, he still believes it is “significantly undervalued.”

“I believe that continuing to ignore Bitcoin will serve those who do it over the next decade as well as it has over the past one – not well.”

Annals of crypto gambling

Startup focus – MyPrize

Eyes on the prize: New crypto casino MyPrize comes with a storied founder. Zach Bruch was involved in the now shuttered NFT platform Recur and modestly claims to have “helped shape the institutional crypto industry into what it is today,” according to a spokesperson.

Having held leadership positions on the institutional trading desks at the likes of Fraken and JST Capital, he ended up creating his own trading operation, which became one of the the biggest on FTX before its collapse.

He subsequently worked on the committee that managed, somewhat against expectations, to recover over 100% of creditors’ money.

Great and the good: MyPrize emerged out of stealth mode in March this year having raised a total of $13m from two funding rounds led by Dragonfly and Boxcars Ventures and including the participation of Mechanism Capital, Arrington Capital, a16z Scout, 640 Oxford, 2 Punks Capital and a host of others.

According to MyPrize, the investors bring “scale and institutional credibility” to what MyPrize claims is the “most valuable” venture-backed social and real-money iCasino.

Shake it up baby, now: The twist brought by MyPrize is it will integrate live streaming and “novel” multiplayer gameplay, allowing for play-alongs with creators who are rewarded for their content via interaction with their community. “You can liken it to when video games became interactive, and users could soon play the same game live with their friends,” says Bruch.

The offering is already live in 170+ markets via Curaçao, while in the US it is available as a free-to-play social casino gaming platform.

“We are bringing a major shift to the online social casino industry, by offering a truly immersive and community-driven experience that’s really never been possible before,” says Bruch. "With the support of our investors and our team’s commitment to rapid product innovation, MyPrize will define the future of online social gaming."

Aussie ban

End credits: Australians can no longer gamble with credit cards and cryptocurrencies. A national ban entered force on Tuesday (June 11) and extends to any lines of credit, along with accounts linked to digital wallets and crypto.

The legislative tweak follows an amendment to the Interactive Gambling Act 2001, which lawmakers passed late last year.

A six-month transition period has now ended, and betting operators risk fines of A$234,750 ($155k) for non-compliance.

Lawmakers handed more powers to the country’s communications regulator to enforce matters.

EU mixer warning

A new set of lies: A group of European Union security chiefs have warned that privacy coins, crypto mixers and off-blockchain platforms are growing headaches for enforcement agencies in efforts to trace illicit finance.

The debut report from the European Union Innovation Hub for Internal Security, a collection of security organizations in the 27-state bloc, analyzed encryption trends and the implications for law enforcement.

In the majority of cases, investigators can trace cryptocurrency transactions and addresses via public blockchains, but new services are appearing that can obscure the visibility of where and how funds move, researchers found.

It’s no secret: Privacy coins such as Monero, Zcash and Grin can mask the identities of the sender, the receiver and the amount being sent.

Despite Monero’s popularity it has not overtaken Bitcoin among criminals, the report said, and it is also being delisted at many exchanges due to money laundering concerns.

Something to hide: Mixers receive cryptocurrencies from users and pool them together in order to obscure the transaction trail, which analysts say “significantly complicates tracing the origins of (illicit) cryptocurrency for law enforcement.”

The developer of Tornado Cash, the most notorious such mixer, was recently jailed for more than five years by Dutch authorities after prosecutors successfully argued the platform was created for money laundering.

Earlier this week, a blockchain analytics firm said the source of an $82m Orbit Chain hack over New Year’s Eve moved $47.7m to Tornado Cash after months of silence.

US representatives recently proposed a two-year ban on cryptocurrency mixers, after alleging they had helped wash funds for much of North Korea’s nuclear program.

Layer cake: The report also singled out Layer 2 solutions, which are protocols that operate on top of a base blockchain, as “open for abuse by criminals.”

They allow for faster transaction speeds and better scalability by periodically batching or consolidating payments, which can also hide the visibility of suspect addresses.

“Law enforcement authorities are advised to stay up to date on such developments to be prepared when they are encountered in investigations,” the report said.

Tether splurge

Burning a hole: Tether CEO Paolo Ardoino said he expects his company to invest more than $1bn into startups in the areas of alternative financial infrastructure for emerging markets, artificial intelligence and biotech.

The new money follows over $2bn of investments in growth companies in the past two years.

On a tear: According to Tether’s Q1 Attestation report, the stablecoin now has a market cap of over $112bn with the company recently benefitting from investing most of the reserves backing USDT into US Treasuries. High interest rates have done the rest.

Ardoino told Bloomberg this week that Tether will keep 100% of its reserves plus an extra 6% to ensure smooth redemptions, but will invest some of its remaining profits into deals.

“It’s all about investing in technology that helps with disintermediation with traditional finance. Less reliance on the big tech companies like Google, Amazon and Microsoft,” he told the newswire.

Table talk: “You can imagine that the news that Tether is making good money went around the world,” Ardoino said. “We get tens or hundreds of deals per month that are on the table, and we only end up doing a very small percentage of that.”

Headlights: At the end of last month, Tether invested $100m for a stake in US-listed Bitcoin miner Bitdeer Technologies with an option to buy a further $50m in shares within the next 12 months.

Events calendar

Jun 19-20: Nordic Blockchain Conference 2024, Copenhagen

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.