Bettors lose over $700,000 as neither candidate offers any crypto mentions.

In Loose change: The SEC’s crypto wins.

UK Bitcoin ATM crackdown continues.

Argentina freezes criminal stablecoin assets.

CZ lifetime Binance ban confirmed.

You say it best, when you say nothing at all.

Not a word

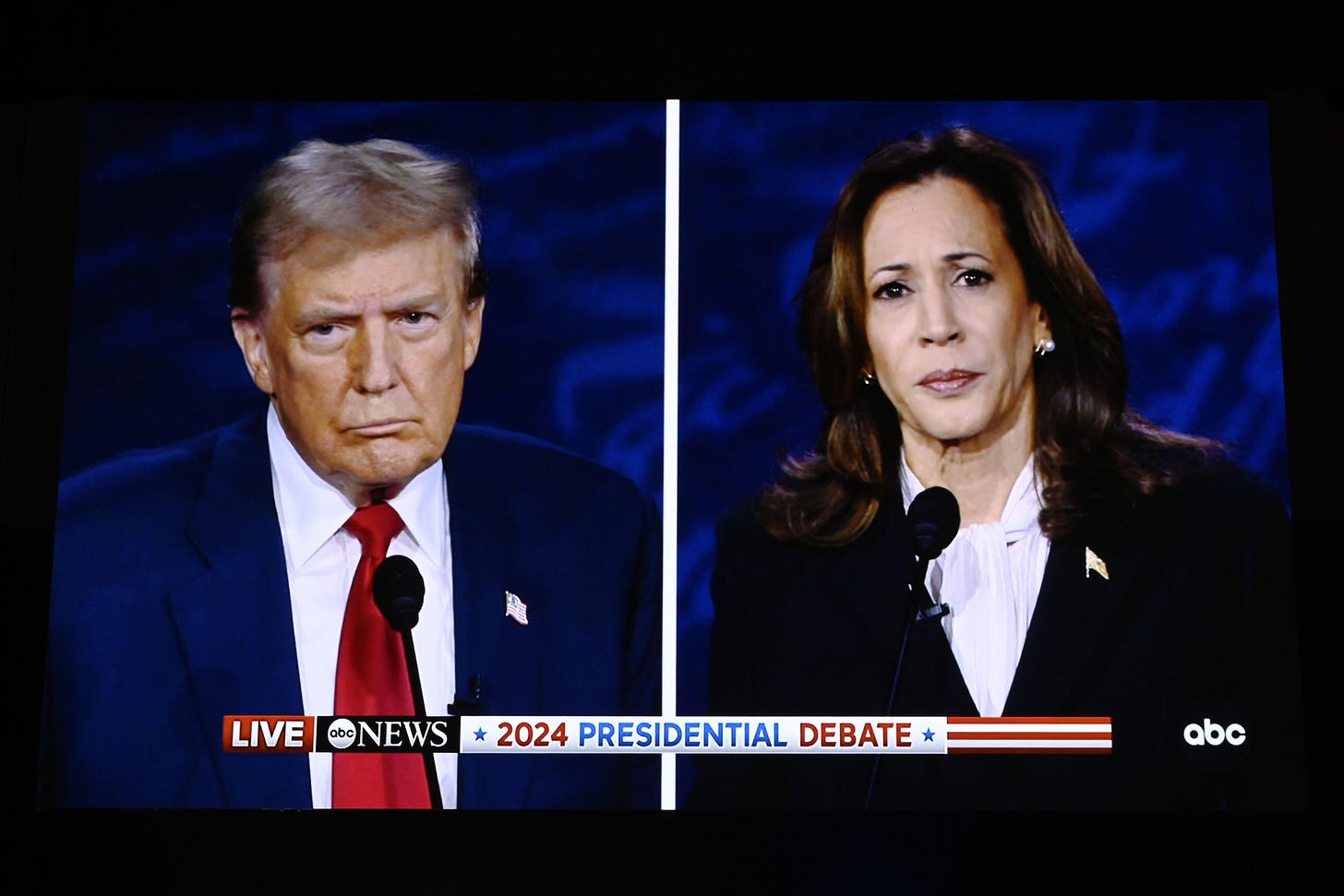

Silence is not golden: The perils of political betting as a consumer activity appeared to be highlighted on Tuesday as neither Vice President Kamala Harris nor her Republican challenger Donald Trump gave mention to the word Bitcoin in their TV debate.

Don’t read my lips: Crypto-based prediction market provider Polymarket reported that bettors wagered ~$217,000 and $502,000, respectively, on whether Harris or Trump would reference Bitcoin or crypto on the debate stage.

The lack of mentions came despite Trump, in particular, previously having appeared willing to promote a crypto-friendly agenda.

Just prior to the debate, Polymarkets suggested there was a 26% chance of Trump mentioning the words while the odds on Harris were 9%.

Meanwhile, the Stand With Crypto advocacy group, launched by Coinbase earlier this year, posted on X a call for the broadcaster ABC to raise a crypto question during the debate.

It also invited users to email ABC for a question to be asked.

Controversy: The prediction market shenanigans came as political wagering hit the headlines after provider Kalshi first appeared to win a big legal victory in its fight against the Commodity Futures Trading Commission only for it to have victory snatched from its jaws.

As Compliance+More reported earlier this week, a federal judge last week struck down the CFTC’s order to stop Kalshi from offering markets on the presidential election.

However, the CFTC subsequently filed an emergency motion to stop Kalshi from offering any markets for at least 14 days.

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

Let it be done: Cryptocurrency exchange Kraken has called for clearer regulations in Australia after a federal court ruled its fiat margin trading product breached local laws. The firm has had to restrict its fiat margin trading services to wholesale clients, though its crypto margin services remain unaffected.

The US Commodity Futures Trading Commission has charged decentralized exchange developer Uniswap Labs with illegal derivatives trading for retail investors. Uniswap settled the charges by paying a $175,000 civil penalty, and has ceased trading certain leveraged tokens as required as part of the agreement.

Indonesian cryptocurrency exchange Tokocrypto, a subsidiary of Binance, has obtained a full license as a physical crypto asset trader from the country's Commodity Futures Trading Regulatory Agency.

Last year, Indonesia introduced a requirement for all crypto exchanges to register with what it called the world's first national stock exchange for crypto assets.

The SEC has raked in nearly $4.7bn from enforcement actions against crypto firms and executives in 2024, according to a new report by Social Capital Markets, putting the agency on course for a record-breaking year.

UK crackdown continues

Withdrawal symptoms: UK authorities have charged a Londoner with unlawfully operating a network of Bitcoin ATMs. Over a two-year period, the machines run by Olumide Osunkoya processed around $3m in crypto transactions.

The Financial Conduct Authority, which supervises crypto activity, said it was the first criminal prosecution relating to unregistered cryptoasset activity under the UK’s money laundering regulations.

It was also the first charges brought against a person accused of running a network of crypto ATMs in the country.

Last month, a London trader became the first individual to be charged with operating a Bitcoin ATM.

There are no legal Bitcoin ATMs in the UK.

Crypto fraud spike

Through the roof: US citizens were bilked of more than $5.6bn last year from crypto-related fraud schemes, the FBI said in a report on Monday.

Officials calculated a 45% jump in losses from 2022, from nearly 70,000 complaints by victims of financial fraud involving Bitcoin, Ether and other cryptocurrencies.

Investment fraud accounted for much of the losses, totalling $3.396bn in stolen funds.

Argentina freeze

Looking for stable: An Argentine court has ordered the seizure of nearly $28,600 in stablecoins from a criminal organization accused of using the assets to launder millions of dollars.

The gang made their money through illegal online casinos and smuggling high-end phones with the help of a corrupt customs official, prosecutors said.

Millions were then laundered via crypto transactions, with Argentina’s Financial Intelligence Unit tracing more than $10m in deposits to the organization’s Binance accounts.

Enforcement officials were able to identify illicitly held USDT stablecoins mixed within other funds.

A lawyer close to the case said while it was “laughable” to expect police to catch the gang, the order was a start.

CZ ban

CZ and desist: Former Binance CEO Changpeng Zhao has received a lifetime ban from “managing or operating” the crypto exchange, according to current CEO Richard Teng.

Teng told Axios that Zhao would be barred from managing the platform for life as a “key condition” of the plea agreement between Binance and US authorities.

The former CEO will complete his jail term on September 29, having pled guilty to money laundering.

Despite being unable to hold any kind of management position, CZ remains the largest shareholder of the crypto exchange and will retain shareholder rights.

Zhao has said upon his release he will take some time off before returning to crypto with a new project.

Events calendar

Sep 25-26: European Blockchain Convention, Barcelona

Oct 9-11: Permissionless III, Salt Lake City

Oct 14-15: Ripple Swell, Miami

Oct 22-23: Blockchain Life Forum, Dubai

Dec 4-5: India Blockchain Week, Bengaluru

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.