SX Network is the next name to conjure with in decentralized betting.

In Loose Change: A China rethink, Trump keeps shilling, Bitcoin slumps.

XDA.io launches an accelerator aimed at gaming startups.

A memecoin warning from a crypto influencer.

Oh, we’re still the greatest, the greatest, the greatest.

SX machine

Get on up: Hopes are high that the decentralized prediction market SX Bet will see its deeply underwater token resurface as evidence grows it is gaining ground in the on-chain betting space.

The SX token experienced a brief pop on launch in 2021, but has been underwater ever since.

However, with the company claiming it controls 15-20% of the crypto-based betting market, the network hopes this will translate into a token price recovery.

A recent blog posting from GambleFi luminary Kris Welch suggested SX Bet was the fourth biggest crypto-based betting outfit.

The basics: SX is the token that fuels the SX Network; SX Bet is the decentralized prediction market for permissionless wagering. SX was founded in 2017 by a team based in Toronto, Canada and headed by co-founders Andrew Young, Jake Hannah and Julian Wilson.

They raised $15m from investors at the time, including CMS, CMCC and Draper Dragon.

SX Bet originally launched on Ethereum in 2019 and subsequently transitioned to Polygon in 2021.

Not the take-up we hoped for, but the take-up we got: Recent research from Alts RSCH pointed out that decentralized betting platforms generally have struggled to compete with the centralized platforms, such as Stake, Rollbit and Shuffle, which have had more success in targeting crypto-based betting punters.

Alts RSCH said that while these apps allow users to deposit and gamble using crypto, they remain “centralized platforms (CeFi) with significant trust assumptions.”

P2P: In contrast, SX Bet is peer-to-peer and uses smart contracts and on-chain settlement to enable trustless wagering. Every bet on SX Bet is recorded on-chain with users placing a bet against an active offer and the wagers being locked into an escrow smart contract until the completion of the event.

Once the event’s results are finalized, the winning user receives their initial wager plus winnings.

Users place bets by ‘taking’ an existing bid or by ‘offering’ a bet of their own.

While users can place offers at any odds they want, only bets with competitive odds are usually taken by other users.

“This creates a free-market environment that improves users’ odds across the platform,” said the Alts RSCH note.

The problem is liquidity: Decentralized platforms such as SX, Polymarket and Azuro are somewhat struggling to gain traction, with Alts RSCH pointing out that the three represent less than 3% of the crypto-betting market globally.

Yet, given the high-profile nature of Polymarket’s rise over the summer with its US presidential prediction markets, this is changing.

“As DeFi wagering continues to take share, a 10% penetration rate seems attainable within the next few years,” said the Alts RSCH team.

“Longer term, DeFi wagering has an opportunity to take share from the traditional Web2 online gambling industry.”

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

A China rethink: China has signaled a potential change in approach to crypto with the country’s former vice-minister of finance, Zhu Guangyao, telling a forum in Beijing that crypto is a “crucial aspect” of the development of the digital economy.

Shilling for crypto: Donald Trump has announced the official opening of the whitelist for his DeFi project called World Liberty Financial. “I promised to Make America Great Again, this time with crypto,” the former President posted on X.

Users can now link their wallets to a KYC database to access the whitelist, which is presumed to allow access to the public sale of the platform’s token.

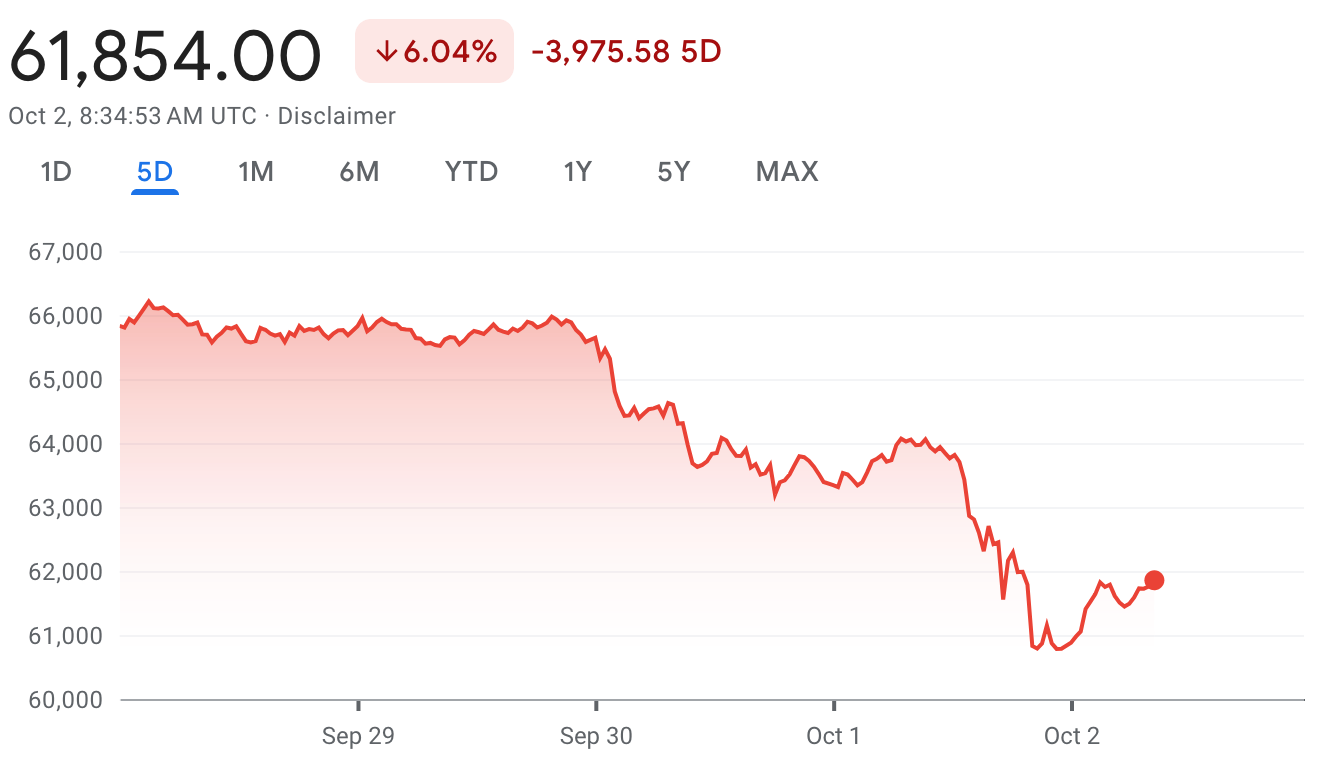

Crypto plunge: Bitcoin took a bath this week, down over 6% at pixel time, as Middle East tension ratcheted up. Observers pointed out this has thrown the usual narrative of October being ‘Uptomber.’

😱 Bitcoin down over 6% this week

What we’re reading

The FT on US election betting: “Election markets already do exist in offshore venues with varying degrees of US legality. There is a steady drumbeat of clamoring from those who want to be able to put money on any uncertain event and who dubiously claim that there is a social benefit in doing so. For now, those wanting to profit off the status of the US Congress may have to continue with synthetic portfolio construction.”

Hit the accelerator

Get with the program: Crypto payments-to-gambling operators facilitator XDA.io has announced a new Accelerator Program aimed at the gambling sector, which it said is “designed to empower startups in gambling and fintech.”

The initiative will give participants access to a network of industry experts and the opportunity for direct investment.

“Unlike traditional investment models, XDA.io exclusively utilizes its own funds, ensuring committed support for the most promising ventures,” the company said in a blog posting.

Know of what we speak: In the blog, Andria Evripidou, CEO of XDA.io, said the company has “seen first-hand how transformative early investment and strategic guidance can be for startups in fintech and gaming.”

“With the launch of our Accelerate Program, we are formalizing what we’ve done successfully behind the scenes for years and opening the door to even more innovation,” she added.

On LinkedIn, Evripidou noted that, as a company that itself only started just a year ago, “we understand the challenges.”

“That’s why we’re offering not only funding, but also mentorship and access to a strong network of industry experts to help businesses scale and succeed.”

Startups interested in applying should click here.

Meme discernment

Think before you leap: The X crypto-trader Ansem – real name Zion Thomas – took to the stage in New York at the Mainnet conference earlier this week to suggest those trading celebrity-backed memecoins needed to show more discernment over which ones to get involved with.

D’uh: “You have to just be more careful with assuming the best out of everybody,” he told YAP Global associate director Debra Nita during a fireside chat.

“Finances are important,” he added.

Don’t be a follower: Ansem noted that, because of the way online works, any project where he is even “tangentially close to or related to” means his followers will take that as an endorsement.

He said celebrities with “millions of followers” can use their “social capital” to recapture people’s interest. However, he acknowledged that it doesn’t always work out.

Scope creep: Speaking to The Block, Nita said it was “interesting to see Ansem enter a new era.” She suggested Thomas had “broadened the scope of his interests, going beyond memecoins and celebrity coins to projects that will have a big impact on the industry like altVMs.”

Events calendar

Oct 9-11: Permissionless III, Salt Lake City

Oct 14-15: Ripple Swell, Miami

Oct 22-23: Blockchain Life Forum, Dubai

Dec 4-5: India Blockchain Week, Bengaluru

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.