Toncoin and Notcoin plunge following Telegram founder arrest.

The NFLPA accuses DraftKings of making a “bad bet” on NFTs.

Binance to more than double compliance.

Thailand hands $14bn crypto fugitive over to China

I ain't no square with my corkscrew hair.

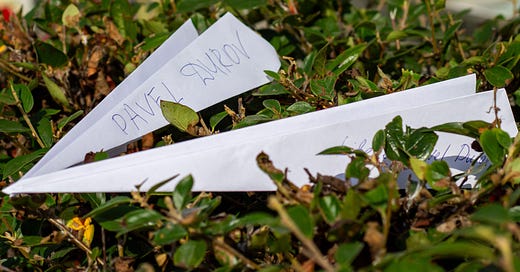

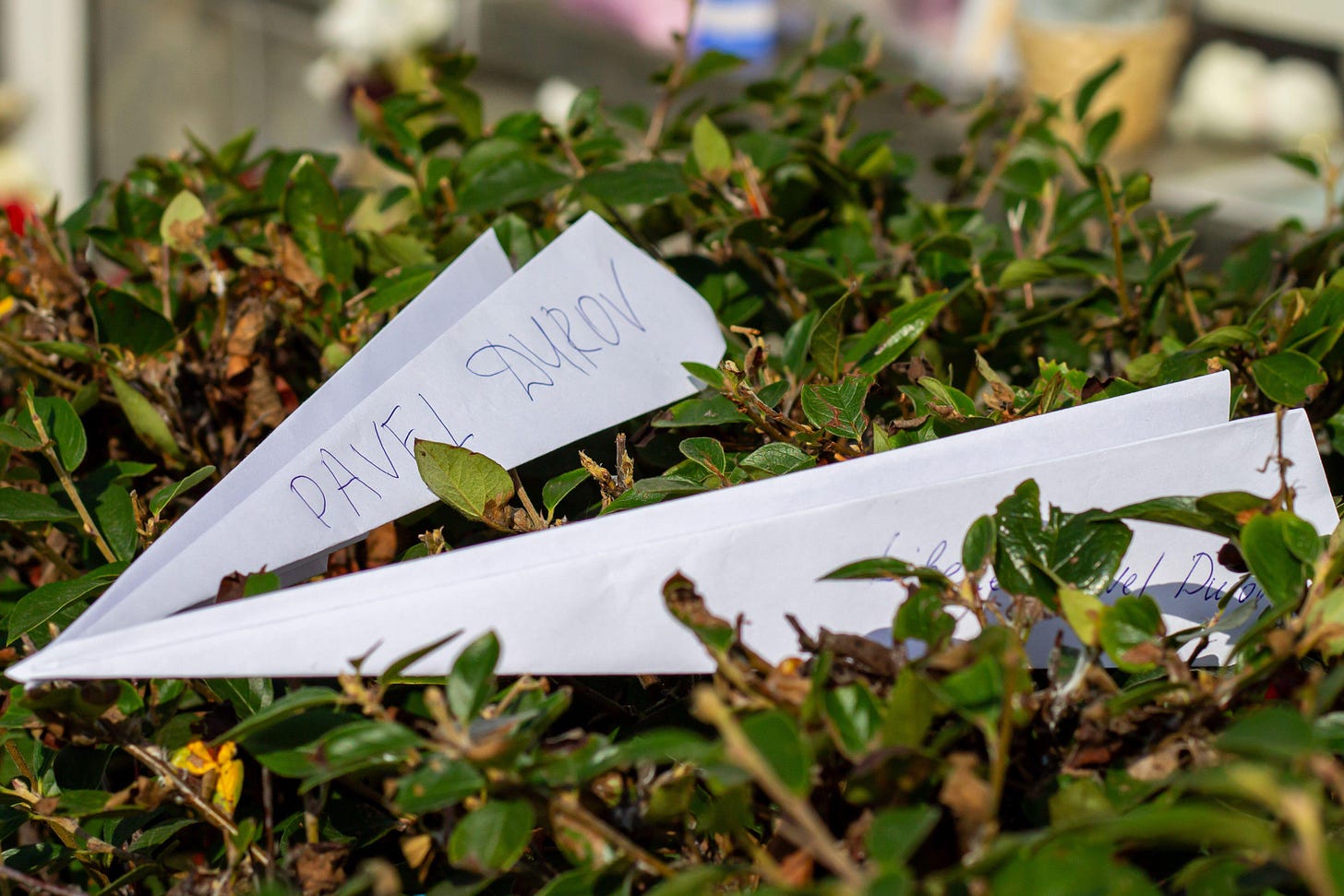

Arresting times

Not bad not well: Telegram-linked crypto tokens Toncoin (TON) and Notcoin (NOT) plunged more than 20% over the week following the arrest by French authorities of co-founder and CEO of the messaging app, Pavel Durov.

Durov is reportedly being held for inadequate moderation of criminal activity on the platform; possible charges include terrorism, drug trafficking, complicity, fraud, money laundering, concealment, and distribution of child pornography.

TON dropped 21% whilst the network’s largest token NOT fell 20%.

French prosecutors have said Durov could be freed today (WEDS), however punters on betting platform Polymarket believe he is likely to remain locked up until at least the end of September.

Telegram is also under investigation in India, with officials probing instances of illegal gambling, extortion and other crimes.

Infamy, infamy: Durov’s arrest may be linked to broadening government hostility towards cryptography, encryption and digital tokens, according to a Galaxy Research report released on Monday.

Analysts at the blockchain firm said Telegram and Durov were likely not complying with information requests from Europe, and the arrest of a prominent social media figure may not be the last.

“It is possible that some of the ‘fraud’ or ‘money laundering’ charges could revolve around Telegram’s integration with TON and/or TON’s use in illegal activity,” wrote Alex Thorn, head of research at Galaxy.

TON was originally conceived as an internal blockchain project at Telegram before the company was sued by the US Securities and Exchange Commission.

Although now separate from Telegram, TON has remained popular with independent developers, and is the native crypto token of the platform.

The token’s value is heavily tied to the fate of the messaging app, Galaxy said.

I hear thunder: Not waiting for French authorities to strike again is Chris Pavlovski, founder and CEO of Rumble, an alternative video platform to Youtube built on “free speech”.

Pavlovski said French authorities were preparing to take legal action against Rumble, and the arrest of Durov prompted him to get packing.

“I’m a little late to this, but for good reason — I’ve just safely departed from Europe,” Pavlovski said on X.

Crypto education and media customized for you.

Bite-sized learning you can apply straight away in real life. Learn the fundamentals and master crypto while processing through LearnCrypto’s learning program, gain practical skills and explore content that is relevant to you.

Navigate crypto with confidence.

Loose change

Crypto-asset service providers (RCASPs) serving New Zealand may have to begin gathering data on reportable consumers who use their platforms as of April 1, 2026. Under a bill proposed by the country’s tax minister, crypto providers would have to disclose the data to Inland Revenue from 2027. The country’s government wants to integrate the OECD’s Crypto-Asset Reporting Framework (CARF) into New Zealand law.

The UK hasn’t approved any new crypto businesses for more than six months, according to the regulator’s registry. Over the last year, the Financial Conduct Authority has received 34 applications, with just four obtaining authorization.

Qu'est ce que: A poll of over 2,000 Americans concluded that individuals who own crypto are more likely to be psychopaths with low levels of critical thinking.

The study was conducted by three researchers from the Universities of Miami and Toronto in 2022, and found a strong correlation between crypto ownership and “dark personality characteristics”.

Leading cryptocurrency exchange Bybit has opened a new office in Amsterdam as part of a planned European expansion.

Crypto miner Rhodium Enterprises has filed for Chapter 11 bankruptcy in Texas, citing liabilities up to $100m. Legal papers cite six subsidiaries and loan defaults totaling $54m.

Two brothers who ran an alleged $60m ponzi scheme by promising investors sky-high returns through use of a trading bot have had their assets frozen by US authorities. Jonathan Adam of Angleton, Texas, and his brother, Tanner Adam, of Miami, Florida, creamed off funds from GCZ Global LLC and Triten Financial Group LLC to buy cars, houses and designer goods, prosecutors allege

Reign fall

Caveat emptor: The NFL Players Association says “buyer’s remorse” on the part of DraftKings is not a valid excuse for terminating the contract related to the NFT project.

The NFLPA says DraftKings “refused to play by its own rules” when it pulled the plug on its Reighmakers and Marketplace NFT platform.

Needing the players’ buy-in, DraftKings “placed a large bet” on NFTs and committed substantial guaranteed payments to facilitate the venture.

“But DraftKings no longer thinks that investing in these collectibles is a good bet.”

Bandwagonesque: The NFLPA says that DraftKings decision to repudiate its license agreement is “simple” – the “once white-hot market for NFTs has cooled down.”

The suit goes on to suggest that DraftKings stated reasons for terminating the agreement with the NFLPA – namely that the recent court decision suggesting its NFTs were securities – were spurious.

“Needless to say, the court’s pleadings ruling did not ‘determine’ anything about the merits of the securities laws claims.”

Pay the ferryman: The suit goes on to say that “at the end of the day, and despite DraftKings’ attempts to muddy the waters, this case is extraordinarily simple.”

“DraftKings’ inability to profitably commercialize the intellectual property it licensed does not excuse performance, and DraftKings must pay what it is due.”

H/T: Kudos to Jessica Welman at SBC Americas who uncovered the sum in question via the means of, er, reading it in the supposedly redacted legal filing where the NFLPA complained that the compensation of five senior executives at DraftKings since 2021 was “approximately quadruple” what the company owes the players organization.

With the total comp coming in at ~$260m, the money owed comes to ~$65m.

Binance compliance commitment

Coming in numbers: Binance is to hire 700 new compliance officers as part of a planned $200m spree on improving its regulatory controls.

The company currently has around 500 individuals dedicated to compliance around the world, and will more than double that figure by the end of 2024, the exchange’s chief executive said.

Richard Teng said the hiring initiative comes as Binance faces increased regulatory scrutiny and ongoing oversight from US agencies.

Earlier this year, Binance’s co-founder and former CEO Changpeng Zhao was sentenced to four months in prison after admitting violation of US anti-money laundering laws.

Last year the firm paid $4.3bn to US regulators to settle charges of money laundering weaknesses.

Can anyone ask for more: The exchange has received around 63,000 requests from law enforcement already this year, compared to 58,000 for the whole of 2023. It now spends more than $200m annually on compliance, which includes costs associated with US monitors, Forensic Risk Alliance and Sullivan & Cromwell.

Binance continues to face legal challenges, with an ongoing lawsuit from the Securities and Exchange Commission (SEC) regarding allegedly unregulated sales of tokens.

Teng said since taking over he has put a renewed focus on compliance, including tightening requirements for listing new digital tokens.

Despite requests from officials, it has yet to release fully audited financial statements and has not designed a location for its global headquarters under Teng.

Thai me down

Running bear: Thailand has extradited Malaysian businessman Tedy Teow (AKA Zhang Yufa) to China over an enormous cryptocurrency scam which raked in more than $14bn from around 10m investors, the majority of whom were Chinese nationals.

Teow was on Interpol’s list of most wanted fugitives, and will be tried on money laundering charges.

It is the first extradition under the Thailand-China treaty since 1999.

Teow was arrested in Thailand in 2022 after fleeing Malaysia, where he is also wanted for fraud.

Chinese authorities said the “extraordinary” case was a “positive example” for future extradition cooperation between itself and other countries.

Events calendar

Sep 25-26: European Blockchain Convention, Barcelona

Oct 9-11: Permissionless III, Salt Lake City

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.